The Vancouver Stock Exchange: A Legacy of Fraud and Money Laundering Part I

- VPMA

- Jan 18, 2020

- 4 min read

Updated: Jul 7, 2020

This blog is the first in a two part series about a particularly corrupt and crime-laden time in the Vancouver Stock Exchange’s history.

“Generally speaking, the most respected fiction writers in Canada are Margaret Atwood and Robertson Davies, but no one churns out a body of fiction as consistently high quality as the companies listed on the [Vancouver Stock Exchange].” – Joe Queenan, Scam Capital of the World

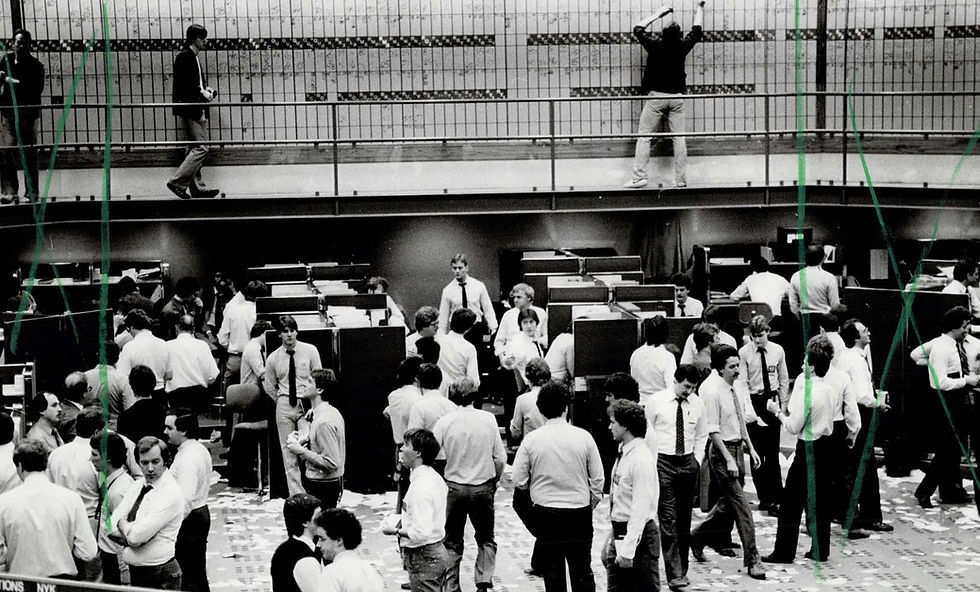

The trading floor of the Vancouver Stock Exchange (1983). Photo credit: Toronto Public Library tspa_0105173f

Written by Matteo Miceli

The once lively trading floor of Vancouver’s former stock exchange very fittingly now plays host to an upscale cocktail bar. Known to many as the “penny stock casino” and “Howe street carnival”, the Vancouver Stock Exchange (VSE) has a fascinating history of corruption, fraud and scandal.

Founded just seven years after the turn of the 20th Century, the VSE was formed in an attempt to compete with the Spokane Exchange, which was attracting BC mining projects that could not secure funding in their home province. Wanting part of the action, and to keep the cash flow on their side of the border, a group of BC businessmen came together to form the VSE with the idea of sourcing local capital to fund local projects. Staying true to its roots for over ninety years, the exchange listed mostly small capitalization natural resource ventures with interests in oil and mining.

The new Vancouver Stock Exchange building shortly after its construction (1929). Photo: City of Vancouver Archives CVA 1399-600

The VSE was a speculative exchange, a launchpad for fresh startups with fewer barriers to listing compared to other markets. In 1989, the capital requirement to list on the VSE was just $600,000, attracting a flock of junior companies and making Vancouver the penny stock capital of Canada—at its peak listing over 2,000 companies. But this lower requirement also attracted a host of get-rich-quick-schemes and outright scams. This period was most prevalent during the 1980s and 1990s, when, in one day, a penny stock could surge one-hundred times its value based on a false press release, crashing back down after insiders unloaded their shares, cashing in for a hefty payday and leaving armchair investors penniless.

In 1981 there was the infamous New Cinch scandal, in which New Cinch Uranium Ltd., much to the delight of speculators, published test results that showed an abundance of gold and silver sitting under property they owned in New Mexico. After the stock surged over ten times in value, third party tests revealed that samples from the property did not contain any significant amount of precious metals and that the New Cinch samples were “salted” to make the venture more attractive to investors. The floor fell out from under New Cinch and its value tanked, losing investors tens of millions of dollars. The VSE was sued for not verifying the company’s test results and, in response, the exchange made it compulsory for companies to issue a disclaimer on each press release stating that the VSE “neither approves nor disapproves of their contents”, effectively absolving the exchange of all accountability.

Headline about the New Cinch scandal. Clipping: The Province Sunday, Dec 13, 1981 – Page 47

This story is sadly not the only one of its kind. The history of the VSE reads like a parade of market manipulation and securities fraud. CHoPP Computer Corp in 1986 claimed it had designed a supercomputer one-hundred-times faster than any competing device, sending shares soaring to record numbers. But it soon came to light that no such computer existed, nor did CHoPP even have the resources to develop one. There was Technigen Platinum, Lessonware, VTech Diagnostics, Pineridge Capital, Axagon Resources and many more. Few of these companies ever faced criminal charges, most were dissolved or delisted and slapped with fines, their executives free to move on to the next project.

While no exchange is without examples of fraudulent companies or insider deals, none seemed so plagued as the VSE. With so many recorded instances of fraud and scandal, it’s no wonder why an estimated five of every six investors lost money on the Vancouver Stock Exchange. It was a self-regulated system that, whether intentional or not, served the very brokers, promoters and insiders at the heart of the organization. The VSE perpetuated this ecosystem of fraud and manipulation because of its inability (or lack of desire) to punish the people behind these fraudulent companies. Since it was one of the only exchanges that did not claim responsibility for the statements made by listed companies, it left its investors to fend for themselves like sheep among wolves. Throughout this period of larger-than-life promoters and million-dollar scams, Canadians unsurprisingly lost confidence in the Vancouver Stock Exchange.

In 1999, after ninety-two years of operation, the VSE merged with the Alberta Exchange to form the Canadian Venture Exchange, which later became the TSX Venture Exchange. But the VSE’s legacy has been immortalized in the words of Joe Queenan, who infamously dubbed it the “Scam Capital of the World.”

Stay tuned for Part II which examines the money laundering that occurred through the Vancouver Stock Exchange.

Comentarii